company tax computation format malaysia 2018

Notification of Change of Accounting Period By A Company Limited Liability Partnership Trust Body Co- Operative Society. Enter the email address you signed up with and well email you a reset link.

Senior Tax Accountant Resume Samples Velvet Jobs

Payment of advance tax by the assessee of his own accord or in pursuance of order of Assessing Officer.

. We do not take the issue of plagiarism rightly. Company Law - 1 Rule 5 of NFRA Rules 2018 as amended from time to time auditors of class of companies specified in Rule 3 of the above referred Rules are required to file with NFRA an. DGFT amends Para 702 of Chapter 7 of Handbook of Procedures 2015-2020 to delete the words basic customs and Para 706 pertaining to Fixation of Brand.

Students from the top universities in the UK US Malaysia Australia Canada and New Zealand buy our service online to acquire top-notch grades in their academic career. Documentary stamp tax is due on the original issuance of bonds in Florida. The computation of charges shall be made on a per kilogram basis except that consignments from the USA may be made on either a per kilogram or a per pound basis.

The Graduate Aptitude Test in Engineering GATE is an examination conducted in India that primarily tests the comprehensive understanding of various undergraduate subjects in engineering and science for admission into the Masters Program and Job in Public Sector CompaniesGATE is conducted jointly by the Indian Institute of Science and seven Indian. Formerly known as Ceylon and officially the Democratic Socialist Republic of Sri Lanka is an island country in South AsiaIt lies in the Indian Ocean southwest. ASCII characters only characters found on a standard US keyboard.

If you are looking for VIP Independnet Escorts in Aerocity and Call Girls at best price then call us. Download Mobirise Website Builder now and create cutting-edge beautiful websites that look amazing on any devices and browsers. The objective of this paper is to investigate and explore the impact of Accounting Software on business performance of Malaysian firms.

Aerocity Escorts 9831443300 provides the best Escort Service in Aerocity. We also have a plagiarism detection system where all our papers are scanned before being delivered to clients. This means the concept is vague in some way lacking a fixed precise meaning without however being unclear or meaningless altogether.

If the proposal is for a modification or change order have cost of work deleted credits and cost of work added debits been provided in the format described in FAR 15408 Table 15-2IIIB. Get 247 customer support help when you place a homework help service order with us. Some of the provisions of ATAD I and II are included in the ATX-MLA syllabus and are examinable from June 2020 onwards.

A fuzzy concept is a kind of concept of which the boundaries of application can vary considerably according to context or conditions instead of being fixed once and for all. All our papers are written from scratch thus producing 100 original work. Computation of advance tax.

The tax or additional tax payable is subject to an increase in tax under subsection 77B4 of ITA 1967. -ˈ l ɑː ŋ k ə. Conditions of liability to pay advance tax.

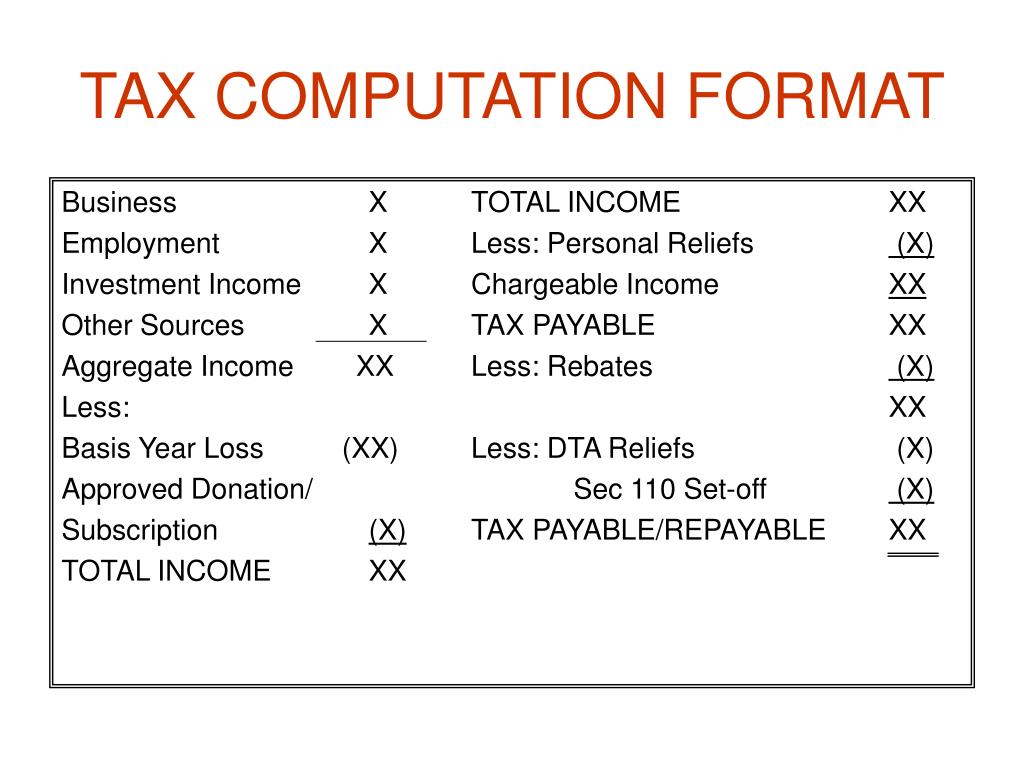

Instalments of advance tax and due dates. S r i ˈ l æ ŋ k ə ʃ r iː- US. Computation Of Income Tax And Tax Payable.

MOBIRISE WEB BUILDER Create killer mobile-ready sites. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Relevant worked examples will illustrate the learning points and tools and techniques in a real-world environment.

The study discusses and explores the effects of using AIS on. And delegate its duties under these terms and conditions to affiliated. During 2018 Malta transposed into Maltese tax legislation the provisions of Council Directive 20161164 issued on 12 July 2016 commonly referred to as Anti-Tax Avoidance Directive ATAD I.

This training course will combine the presentation of analytical techniques examples and case studies. It has a definite meaning which can be made more precise only. As a company we try as much as possible to ensure all orders are plagiarism free.

Computation and payment of advance tax by assessee. Get 247 customer support help when you place a homework help service order with us. As a company we try as much as possible to ensure all orders are plagiarism free.

I also understand that I will need to open a personal account at Bangkok Bank and transfer into it 400K from our joint account 2 months before applying for a one year visa extension based on marriage after coming to Thailand on a Non-Immigrant 0. The amount of increase in tax charged for an Amended Return Form furnished within a period of 6 months after the date specified in subsection 771 of ITA 1967 shall be 10 of the amount of such tax payable or additional tax payable as shown in the following formula-. All our papers are written from scratch thus producing 100 original work.

FAR 15408 Table 15-2 Section III Paragraph C. Notes and Other Written Obligations to Pay Money The tax rate on a written obligation to pay money is 35 for each 100 or portion thereof of the obligation evidenced by the. Tax Guru is a reliable source for latest Income Tax GST Company Law Related Information providing Solution to CA CS CMA Advocate MBA Taxpayers.

Of Tamil Nadu reduces the rate of tax payable under TN VAT Act 2006 by an Oil Company on sale of Aviation Turbine Fuel including Jet fuel to domestic freighter aircrafts de. We also have a plagiarism detection system where all our papers are scanned before being delivered to clients. Thank you Peter.

6 to 30 characters long. If you want top-quality assignments help from the highly experienced writers at convenient prices. Friendly synonym cv.

The tax rate is 35 per 100 or portion thereof based on the face value of the bond. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. For price revisionsredeterminations does the proposal follow the format in FAR 15408 Table 15-2.

Yes I will continue to pay US federal income tax filed by our CPA in the US. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. Must contain at least 4 different symbols.

Foreign Nationals Working In Malaysia - Tax Treaty Relief.

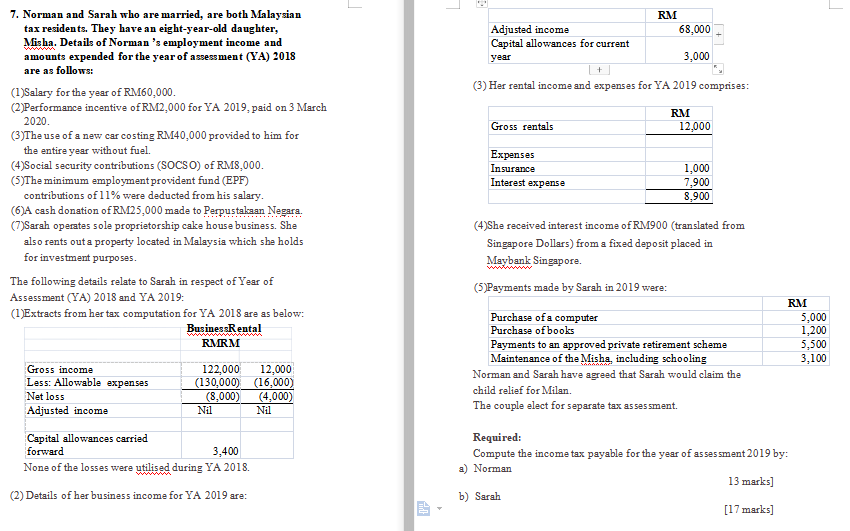

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

How To Prepare An Income Statement A Simple 10 Step Business Guide

The Territorial Impact Of Covid 19 Managing The Crisis Across Levels Of Government

Excel Invoice Template Free Download Invoice Simple

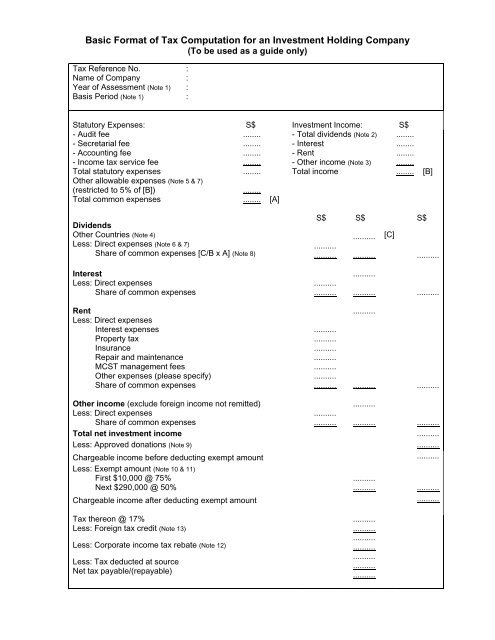

Basic Format Of Tax Computation For An Investment Holding Iras

Newsletter 30 2018 New Information Required For Company Income Tax Return Form E C For Ya 2019 Page 001 Jpg

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

How To File A Small Business Tax Return Process And Deadlines

Income Tax Malaysia 2018 Mypf My

Ppt Lecture 7 Powerpoint Presentation Free Download Id 50109

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

3 12 16 Corporate Income Tax Returns Internal Revenue Service

Provision For Income Tax Definition Formula Calculation Examples

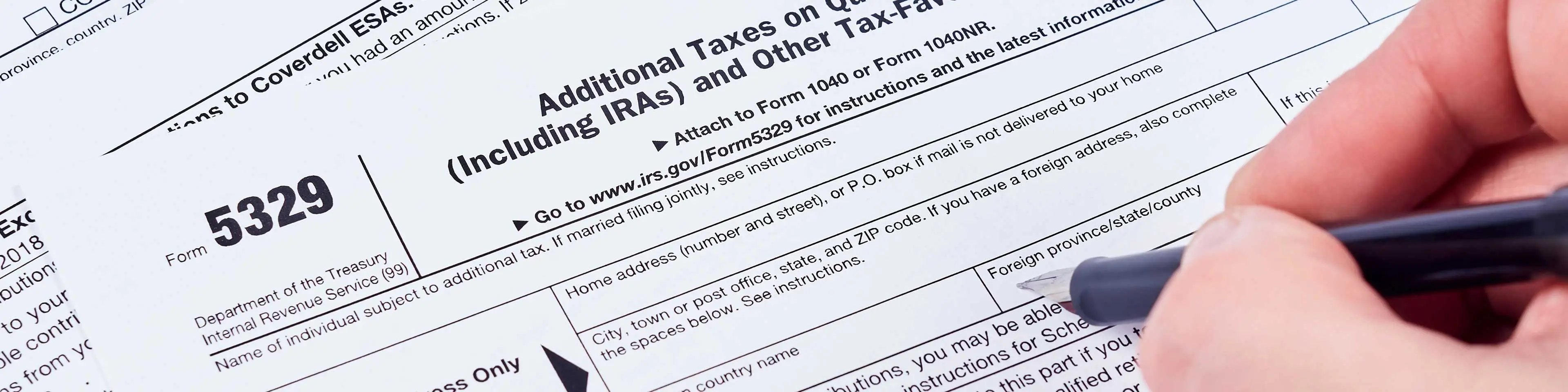

Ira Distributions Prior To Age 59 Irs Form 5329 Filing Requirements Wolters Kluwer

Mind Map Tax667 Trust Pdf Course Hero

How Central Asians Pushed Chinese Firms To Localize Carnegie Endowment For International Peace

Getting To Know Gilti A Guide For American Expat Entrepreneurs

How Does The Current System Of International Taxation Work Tax Policy Center

0 Response to "company tax computation format malaysia 2018"

Post a Comment